Our Approach

Problem

Because of a general lack of resources on how to research DeFi, and the absence of oversight, standards and regulation, retail investors are particularly exposed to a variety of risks.

As a result, bad actors and ill-prepared projects can exploit consumer trust and their investments.

Solution

Using a first-principles approach to fundamental analysis, CRCI Reviews apply an intelligently weighted point system to important metrics, generating a confidence score (CRCI Score) that measures transparency, user protection, and accountability.

Objective

To raise standards and expectations of operational processes in order to improve the quality and availability of key fundamentals from our DeFi builders.

This publicly available content helps reduce the impact of bad actors, ill-prepared projects, and empowers the community to make better informed investment decisions.

The Spectrum of DeFi Research

TECHNICAL ANALYSIS

(Trader)

Pros:

-

Studies historical on-chain data

-

Post mortem insights

-

Verification of declared intentions

Cons:

-

Lacks context in isolation

-

Impact heavily reliant on data volume

-

Ignores fundamental and sentiment analysis

-

Struggles with new or illiquid assets

-

Relies exclusively on pattern analysis

-

Needs constant monitoring

-

Interpretations of data can vary

FUNDAMENTAL ANALYSIS

(Investor)

Pros:

-

First line of research (DYOR)

-

Direct study of the source material

-

Factors operational insights

-

Long-term investment consideration

-

User auditable field of analysis

-

Explores intrinsic asset value

-

Offers context beyond trends

-

Informs decisions, reduces noise

-

Includes balanced technical and sentiment considerations

Cons:

-

Wide variety of influential factors

-

Fails at short term price movements

-

Time-consuming and complex process

-

Interpretations of data can vary

SENTIMENT ANALYSIS

(Speculator)

Pros:

-

Real time social insights

-

Helps anticipate trend shifts

-

Reflects immediate market reactions

Cons:

-

Triggers FOMO

-

Emotion-driven, lacks objectivity

-

Prone to groupthink and herding

-

Unreliable for market predictions

-

Prone to deception and fake news

-

Bad actors thrive in this domain

-

Lacks context in isolation

-

Generally ignores fundamental and technical aspects

-

Difficult to quantify and standardize

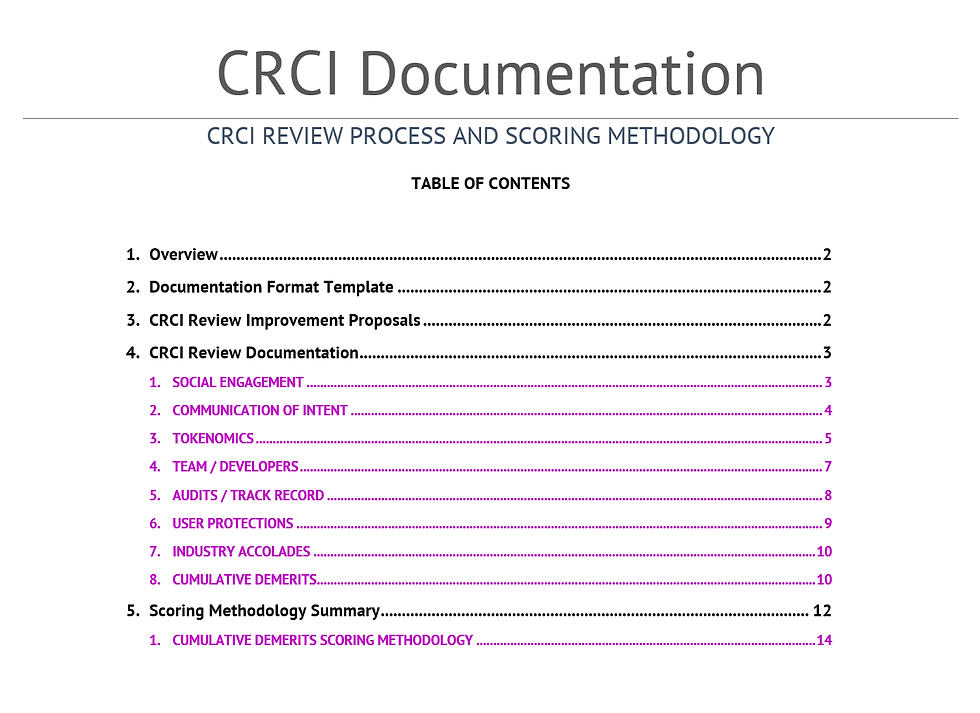

The CRCI covers

28 metrics across 8 categories

Proposal

1. Social Engagement

Quality of content. How active and engaged the project is across mainstream social channels. Communication, presence, and community awareness. Website provides all expected content.

2. Communication of Intent

Assessment of the whitepapers and other forms of presentation in terms of communication of the specific problems they are addressing and their path to intended solutions. Measurement of the impression of depth among competitive projects.

3. Tokenomics

Clarity of the tokenomic model with attention to token allocations, including vesting schedules. Consideration of the token functions. Also an overall assessment of perceived fairness and “rug-ability” exposure.

4. Team / Developers

Publicly visible and trustworthy team and advisors. Declared and/or perceived caliber of domain experience, development expertise, and any industry partners’ combined ability to execute.

Implementation

5. Audits / Track Record

Assessment of public third-party code audits, considering audit cadence congruent with updated products and services. Consideration of the performance / track record of the project. Survey of the public GitHub repo.

6. User Protection

User advocacy. Interactions on the platform are clear. Documentation, guides, education, support. The degree to which the user is protected against unintended actions.

7. Industry Accolades

Reputation. Notable sources of recognition of actions, initiatives, contributions, awards etc. These may come from the crypto community, the broader crypto industry, or credible external sources.

8. Cumulative Demerits

Project failures of any kind. Any activity, behavior, misrepresentation, lack of transparency or clarity that may either intentionally or incidentally misdirect or undermine the project’s participants, community, or ecosystem.

Making Sense of DeFi Tokenomics

The standardization of tokenomic models is an important and exclusive feature of our CRCI Review process and offers a way to compare tokenomic models more directly.

By analyzing data from from a substantial number of tokenomic models, the CRCI is able to identify industry trends and detect patterns that could suggest potential exposure to liquidation events by the project team or early investors.

How We Standardize Tokenomics

Extensive and Concise

CRCI Review Process Documentation

Consistency and objectivity are fundamental to CRCI's review platform. We are committed to these principles, constantly refining our processes to stay in step with the dynamic DeFi landscape.

Our comprehensive documentation establishes clear standards for our reviews, ensuring the CRCI Score accurately mirrors the publicly available information we review.

We are dedicated to continuous improvement, driven by constructive feedback and open dialogue. This approach embodies our commitment to accountability—a quality we champion in ourselves and we all expect from DeFi leaders.

By humbly embracing constructive criticism, we aim to set a precedent for transparency, user protection and accountability within the DeFi community.